For over 100 years, capitalists bought companies to earn income from their operations, rather than from reselling them at a higher price regardless of any lack of income. Buying a company for the income it produces is very different from buying a company that has little or no real net income, hoping that someday it will and that you can sell it at a higher price when and if it does. That is the very definition of gambling – it is not investing. Buying a Picasso or Rembrandt, or any piece of art, hoping you can sell it in the future at a higher price is gambling. There is zero intrinsic investment value to an asset that produces no income. To prudently earn money with your money, you must invest in companies that have a substantial history of reliably and consistently producing a net profit and distributing a share of that profit to its shareholders. For over 100 years, capitalists have invested their money to earn a profit on and from operating companies. And the first question I asked was “What is my payback period?”; i.e. how long will it take me to recover my investment from the earnings of the company? Six years? 12 years? 18 years? Who knows what the world will look like in 18 years? Investing with the idea that in 18 years you’ll break even is not investing at all; it’s an outright gamble, unsuitable for prudent investors.

I have 40 years of experience investing on Wall Street. For many of those years, I could and did buy companies for clients that would pay a dividend of 5%, were cash-rich and had very little debt. Today, no such company exists. There is not one company that pays a 5% dividend, is flush with cash and has very little debt. Today, there is not one publicly-traded company for any prudent investor to invest in.

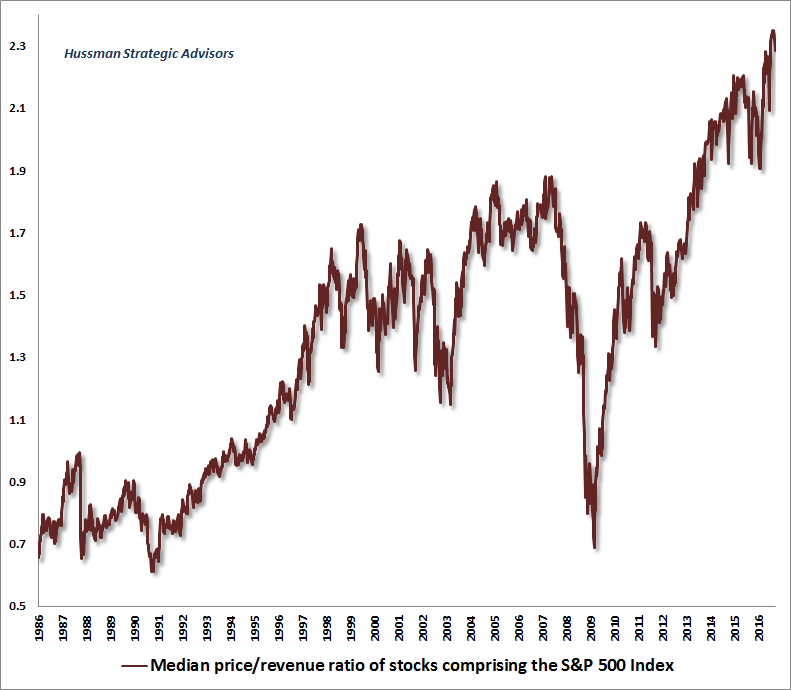

Below is a chart of the price-to-sales ratio of the companies that make up the S&P 500. These are mostly the largest companies in America. Today, the great majority of them are loaded with debt, have very little cash and pay negligible dividends, if at all.

The price-to-sales ratio is absolutely a reliable indicator of risk. The market hasn’t been this risky since 1929.

This is a very dangerous time to invest, and we don’t recommend investing at this time.

The above chart was originally posted on David Stockman’s Contra Corner. Click here to view it in its original page.