Why Choose ERS?

1) Fewer losses.

2) Fewer significant losses.

3) Safer stocks with a high probability of gains and high

potential for significant gains

4) A reliable technology to rate risks and opportunities.

About Equity Risk Sciences

•Over 9 billion financial data points

•Time-tested over 30+ years

•Fundamentally based, statistically proven

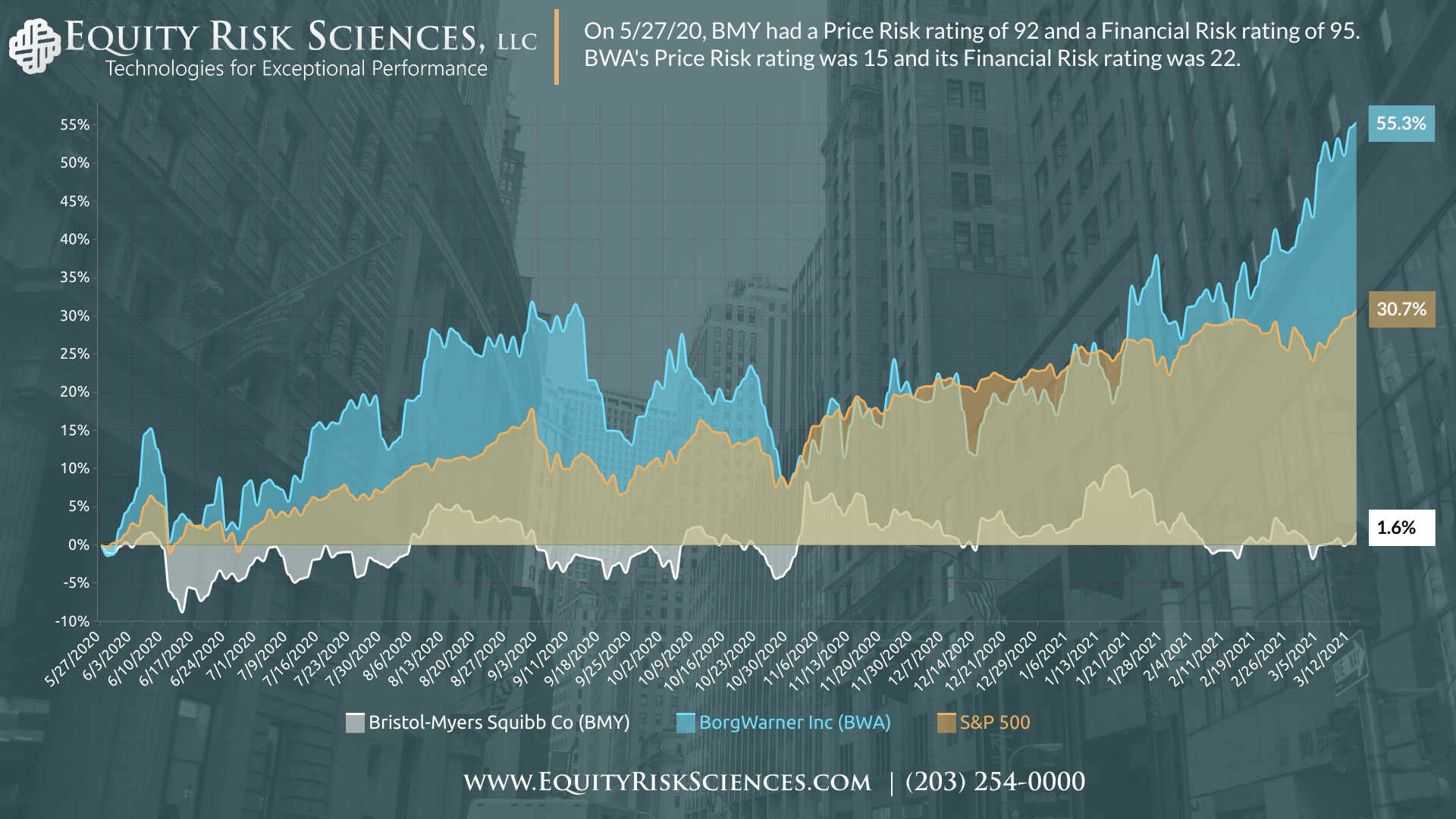

•Single Stock Risk Analysis

Equity Risk Sciences’ proprietary risk ratings give institutional investors and financial advisors unbiased and reliable assessments about the warranted valuation and financial safety of individual stocks. Each day, ERS’ technology assesses the likelihood of gains or losses from any stock in North America, based on current valuation and financial conditions.

Our algorithms are designed to guide you towards responsible, low risk investing with the highest returns possible. We cannot guarantee that you will not experience loss, but you can rest assured that any losses incurred will be less frequent and less significant than traditional investment strategies. We are so confident that you will find success with us, that our rates are customized and scaled based on how well your investments perform. Who else in the industry can offer you that?

Regardless of the investor’s personal investment philosophy, ERS risk models can simplify the search for the right investment universe and help identify the right stocks to research, what to pay for them, and to monitor changes in their risk over time.

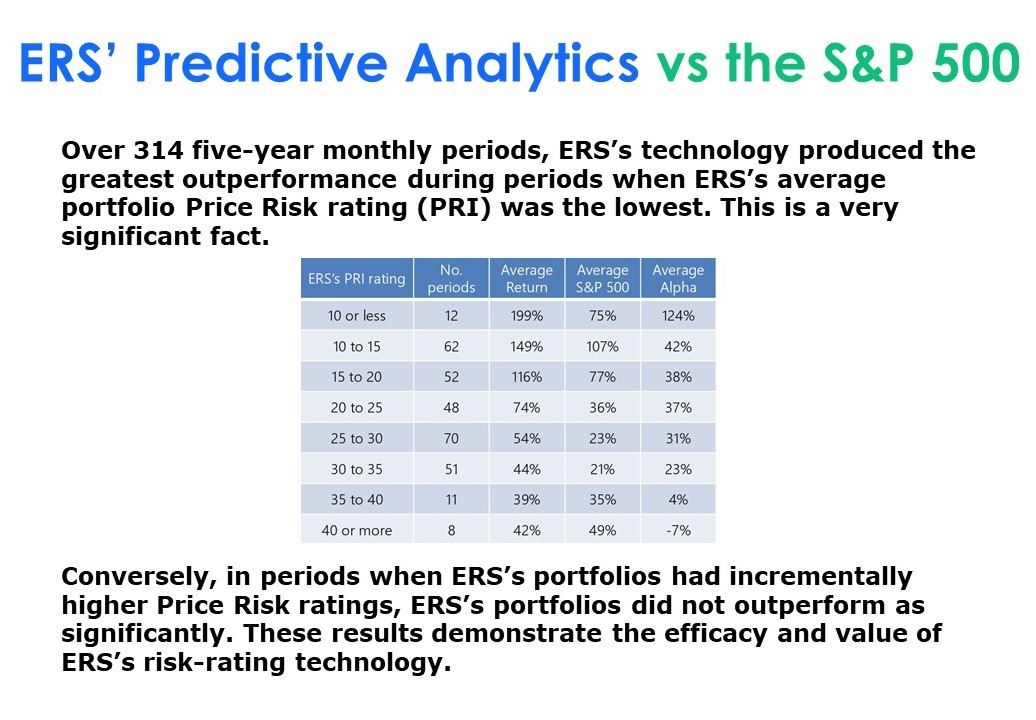

We call it Single Stock Risk Analysis. Back tests show that the companies with the safest ERS risk scores dependably outperform the equity market over virtually all timeframes; those rated riskiest underperform both the market and safer ERS-rated stocks. Subscribers access risk ratings via a robust toolkit of web applications. The tools allow for sophisticated screening, deep individual stock analysis, customized timeframe analysis for single stocks, monitoring overall portfolio risk changes, and testing theses on decades of historic data.